Will investing in Emerging Markets (EM) provide a comfortable retirement and more financial security?

Will investing in Emerging Markets (EM) provide a comfortable retirement and more financial security?

At BFM, we help clients make better financial decisions to create peace of mind.

Our core beliefs are:

• Asset Allocation is the most important determinant of performance

• A globally diversified portfolio reduces risk

• A disciplined investment process is critical

BFM enables its clients to increase their wealth through independent financial advice with no conflict of interest. We neither sell products nor receive commissions.

Executive Summary

Emerging Markets (EM) have:

• A growing middle class and domestic consumer

• A young and growing population

• Stocks that are not expensive

• High growth rates

• Low debt

In summary, portfolios with a portion invested in EM may be good strategy to reach long-term goals.

Introduction

If you grew up during the 1970s and 1980s, you were used to seeing “Made in Japan” imprints on many toys and household items. Later, “Made in China” emerged to be the new norm. Today, the prevalence of emerging economies is widespread.

As a global investor, BFM acknowledges that emerging markets cannot be ignored.

Following the great performance of the S&P 500 of more than 200% (total return) since March 2009, we are no longer bullish on U.S. stocks (see June 2014 charts).

Home country bias is a universal tendency for people around the world so U.S. or French investors are no different; they are prone to emphasize U.S. or French stocks in their portfolios. After all, the companies behind these stocks are more familiar. The last few years, the U.S. economy fared much better than many others, and the U.S. stock market has performed very well. In contrast, global diversification has been touted as a superior strategy for equity investors because investing in stocks in many markets around the world, reduces the concentrated risks of investing in one market alone.

Our research team has decided to shift its focus to Emerging Markets (EM).

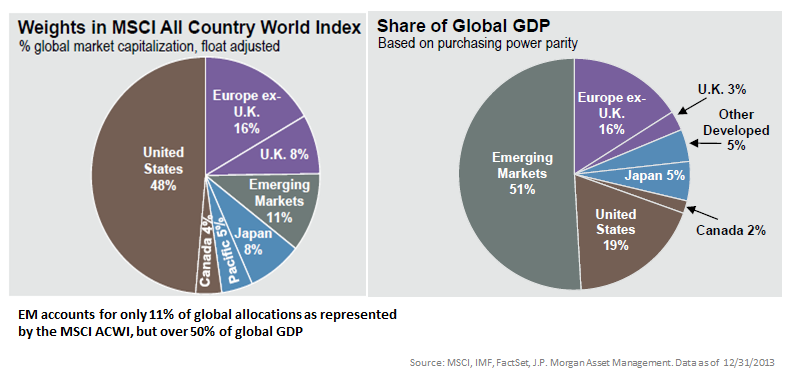

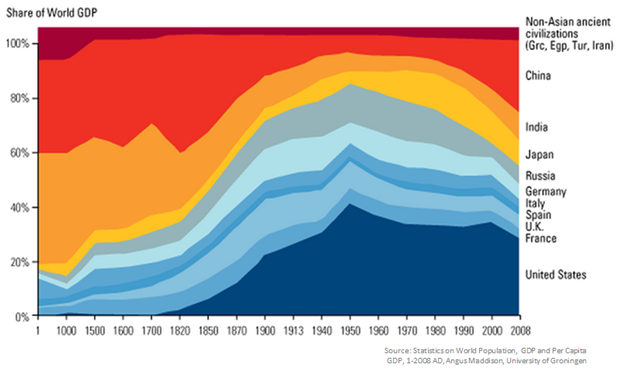

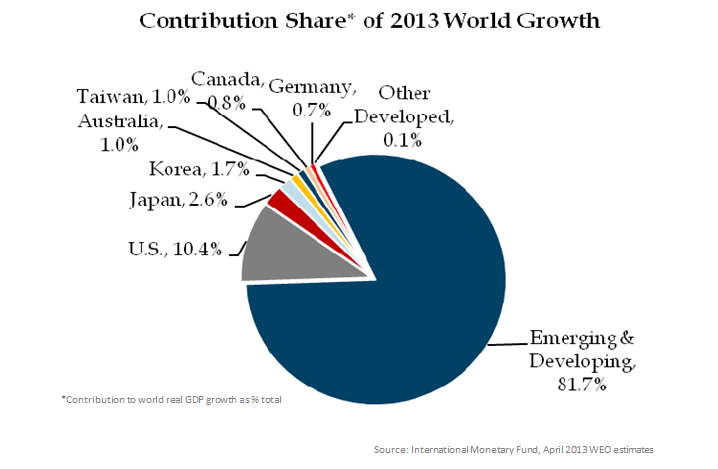

Thirty years ago, EM made up just 1% of the world equity market capitalization compared to 11% in 2013 (which may be underestimated). They comprise 51% of world economy (GDP on a purchasing power parity basis), representing 82% of global GDP growth and more than 80% of the world population. They are in better shape today and are less risky than during the past crisis. EM are already too important to ignore and they are a good source of diversification for portfolios. We understand that in a roaring stock market, our philosophy of “prudent diversification” can be challenging. Here is a good insight from one of the greatest investor:

“The only investors who shouldn’t diversify are those who are right 100% of the time.”

Sir John Templeton

At BFM, we believe the fundamental long-term investment case for EM is good.

There are many reasons to be optimistic about EM. Many countries have sound macroeconomic, financial, and policy fundamentals. Other positives are the urbanization, industrialization, strong economic growth, catch-up growth from low per capital income, companies that have better profitability and higher dividend per share, a good demographic (for most of EM countries), a more stable middle-class, and the rise of a consumer society. We believe these good fundamentals will serve investors well in the long run.

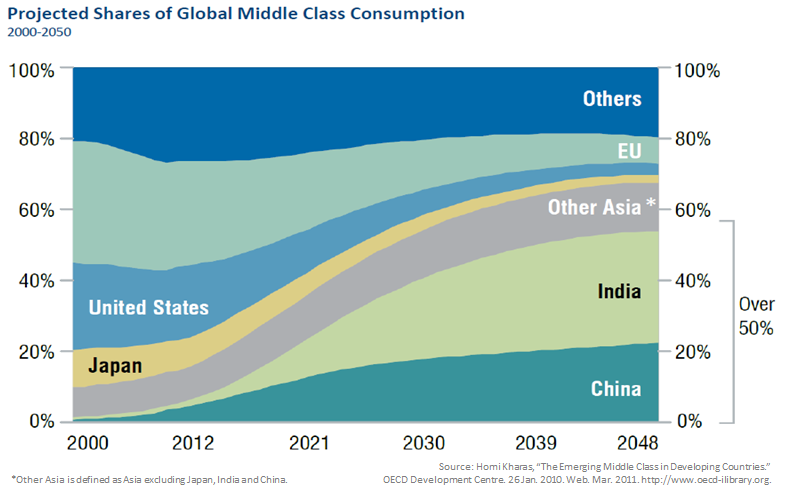

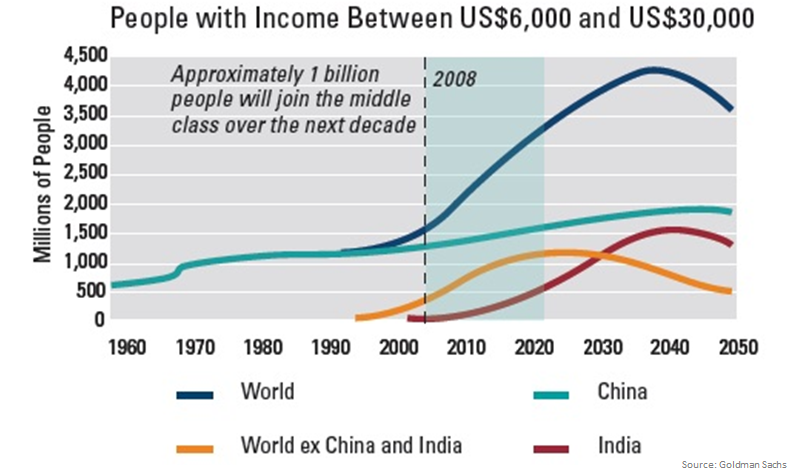

By 2030, middle class spending is expected to increase six-fold in the Pacific region. The number of millionaires in China already passed the one million mark in 2010. The number of billionaires is expected to grow more than 80% in China, 63% in Russia, 67% in Brazil and 36% in Turkey.

We saw a massive structural shift in credit standing during the last decade. EM are actually creditors to the rest of the world. They hold nearly 80% of global foreign exchange reserves.

Potential risks include volatility, inflation, currency, and political risks. Also, the unwinding of Quantitative Easing (monetary policy to stimulate the U.S. economy) could result in a stronger dollar. China is experiencing a slowdown. Furthermore, EM experience more corruption and less transparency. Despite all this, we believe the emerging markets remain an attractive source of mispriced opportunities and that some mutual funds managers are best suited to exploit these inefficiencies.

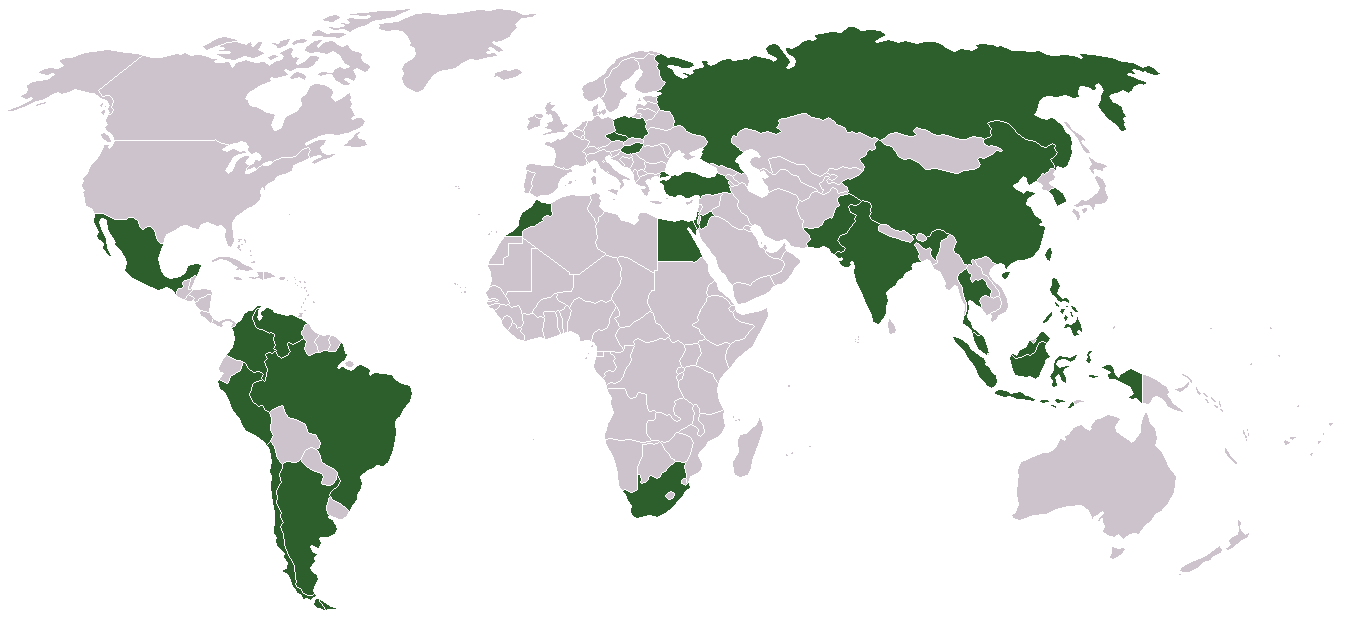

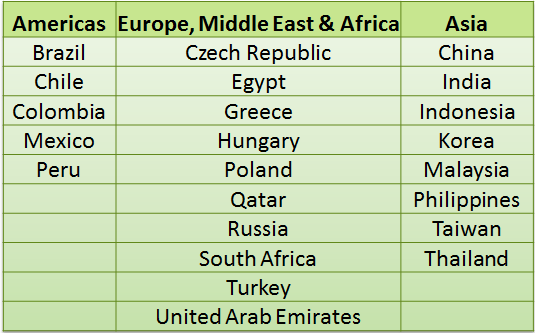

List of Emerging Markets Countries

1. GDP Growth

Country’s GDP (Gross Domestic Product = Economy) Goes Through Cycles

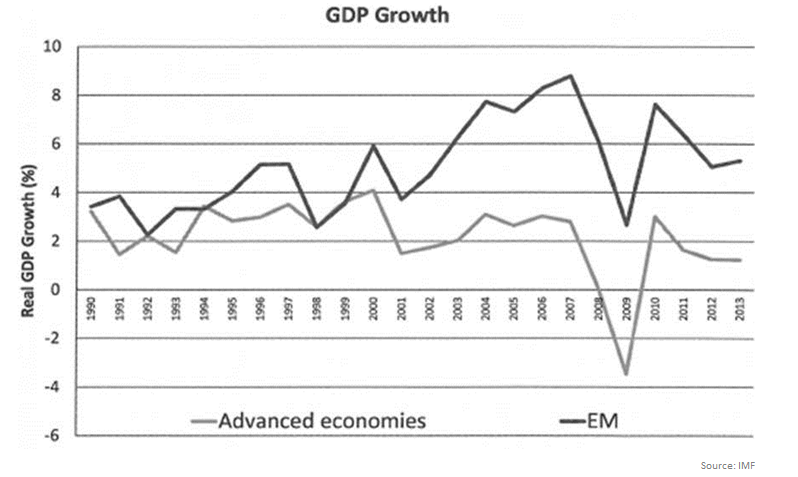

EM contribute the most to the world growth. Their growth rates are twice the level of advanced economies. By 2025, there is a possibility of 4 Emerging Markets Countries being in the G7.

EM have Become a Bigger Portion of the World Economy (GDP) and Stock Market Capitalization

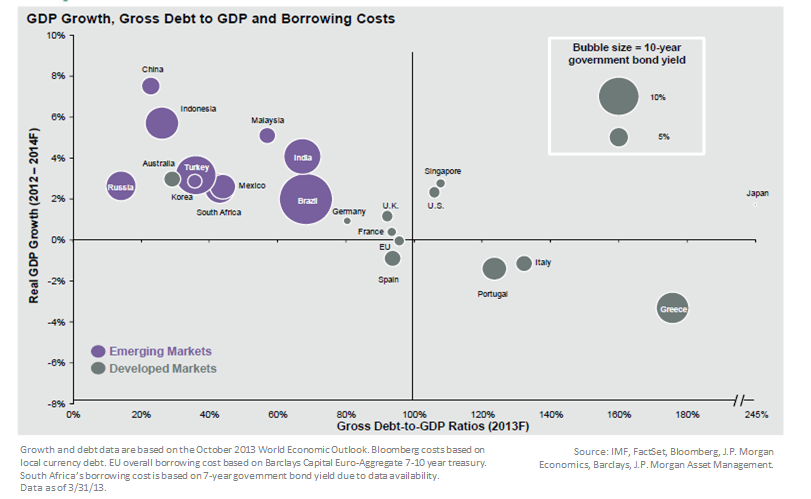

EM are Growing Faster (Higher GDP Growth) and Have Lower Debt

2. Young and Growing Population

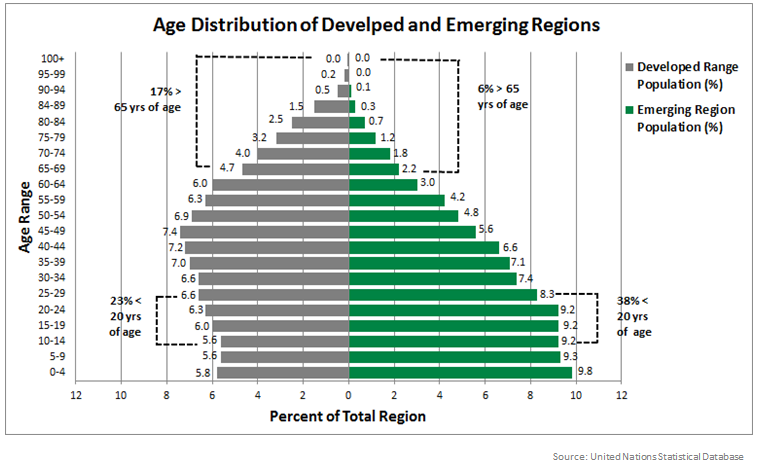

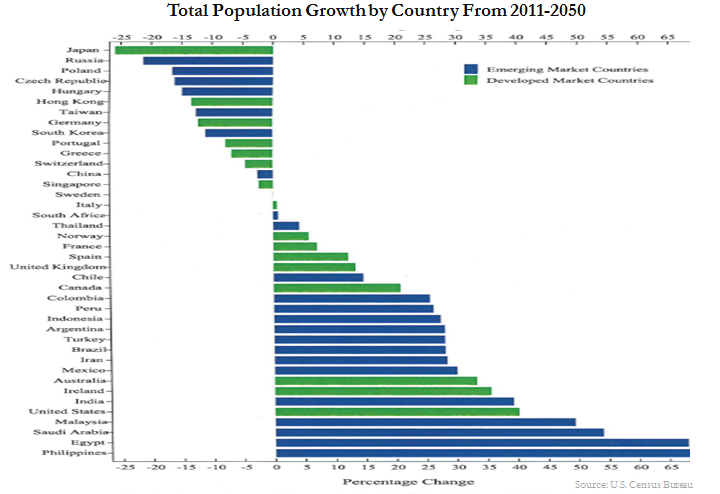

EM Population is Growing Fast

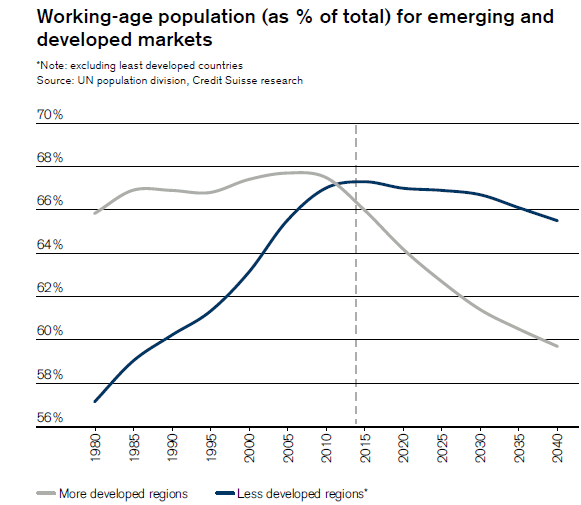

The Working-Age Population is Larger

3. Increasing Purchasing Power

EM Consumer Market is Growing Fast (Lead by China and India)

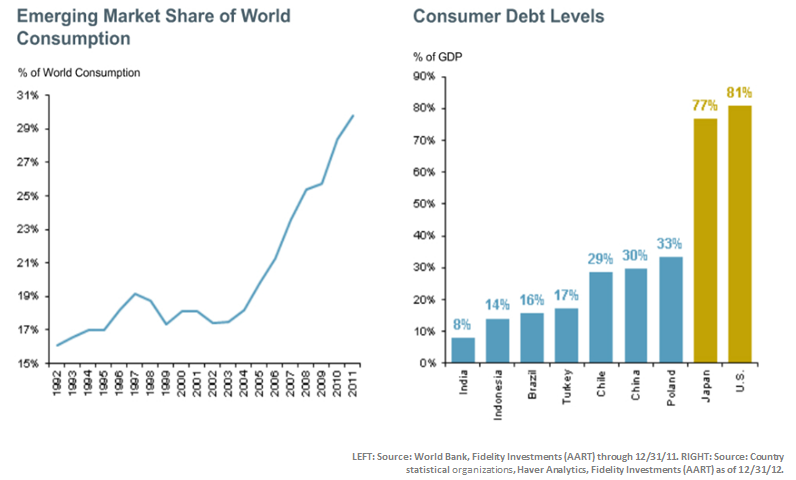

EM New Consumers with Low Debt are Entering the Global Market

4. Higher Returns and Not Expensive

EM Stocks' Returns Outperformed Advanced Economies (AE)

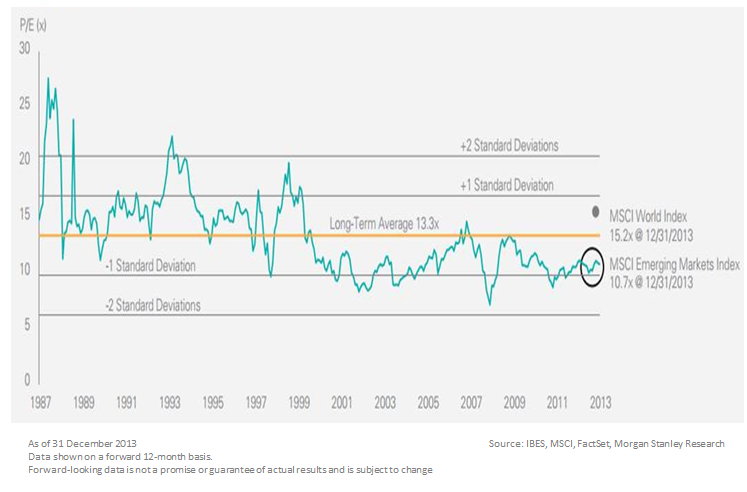

EM Stocks Do Not Seem Expensive Relative to Other Countries' Stocks

But EM Returns are More Volatile...

EM experience huge swings: a 39% gain in 2007, for example, followed by a 53% tumble in 2008, and a 78% rebound in 2009.

5. Low Debt

The Debt Burden of EM is Lower

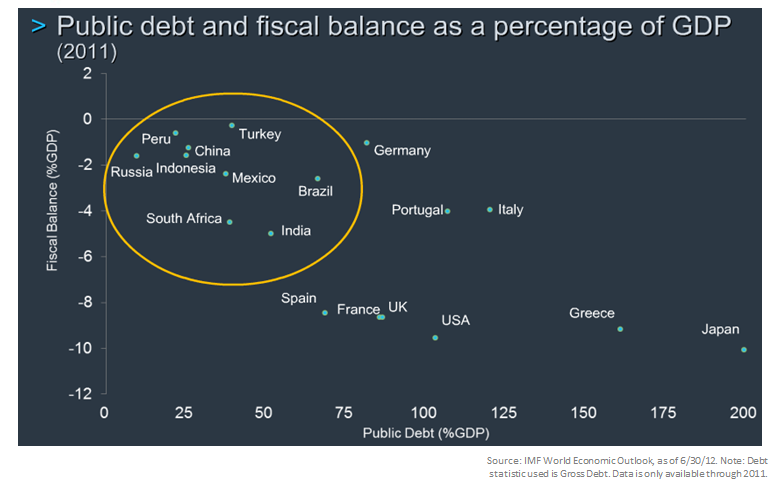

EM Have Low Public Debt and Better Fiscal Balance

Conclusion

BFM recommends globally diversified portfolios that include emerging markets!

We would welcome the opportunity to know you better, introduce ourselves, share with you the work we do for our clients, and position ourselves as a useful resource for you. It would be a wise first step towards achieving your vision.

Getting to know you, your needs and motivations, is almost as important as you evaluating our capabilities to help you meet your financial goals. We do not charge a fee for our initial consultation during which we review your portfolio, and listen to your goals and objectives.

What type of clients do we have? Our clients are located across the globe including North America, Europe and Asia. We have an unbiased approach in selecting our clientele i.e. our client base is broad encompassing expatriates, executives, entrepreneurs, working professionals, and business individuals. We welcome all clients from individuals with wealthy multi-million dollar portfolios to individuals who currently have negative net worth.

We have no portfolio size minimums.

Learn more about our straightforward flat fee conflict-free compensation model.

We have discovered that one of the most valuable things we do for our clients is guiding them on selecting better mutual funds and making sure they have enough assets as long as they live. If you have any ideas on how we should connect with people in such situations, your advice would be a great help.

This newsletter was first published in September of 2014

https://us4.campaign-archive.com/?e=[UNIQID]&u=573d134676472fe56336c7f4f&id=c297523706