Scary facts you should know

16 SCARY Facts You Should Know

"Every day is Halloween, isn't it? For some of us." (Tim Burton)

In summary, this newsletter is about investment strategy, life expectancy, how much to save for retirement, inflation, healthcare/education costs, adviser compensation...

If you prefer a video about it, check out the CEO Money Show Interview.

It is scary to find out...

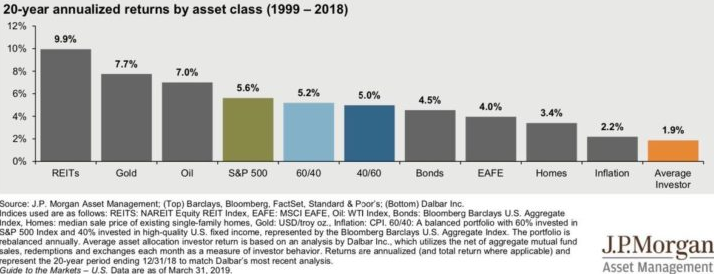

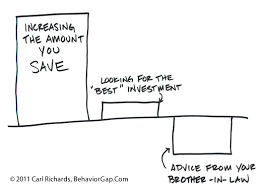

The average investor performance over the last 20 years was 1.9% per year (45% cumulative so $100,000 became $145,708) while a balanced portfolio composed of 60% in stocks and 40% in bonds had a performance of 5.2% per year (175% cumulative so $100,000 became $275,623) which is $129,914 more!

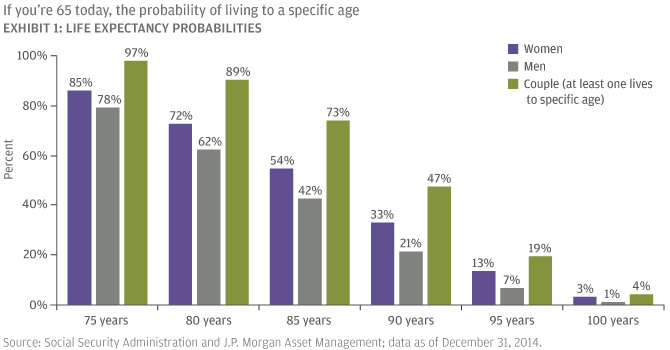

How long retirement could be! At least one member of a 65-year-old healthy couple has a 43% chance of making it to at least 95 years old (retirement of 30 years).

One member of a 65-year-old couple has a 47% chance of making it to at least 90 years old.

Discover your life expectancy: www.livingto100.com.

The world’s oldest, verified, person was Jeanne Clement. She was born in 1875 in Arles, France, and died 122 years and 164 days later in 1997. The next on the top-five list was ‘only’ 119, or possibly 117 years of age.

Jeanne Calment, 122 years

Sarah Knauss, 119 years

Lucy Hannah, 117 years

Marie-Louse MKeilleur, 117 years

Emma Moreno 117 years *

Moreno is still alive in spring 2017

Source: NTB scanpix / Norway Today

Scientist thinks the world’s first 200-year-old person has already been born

Could babies born today live to 150?

If you spend $55,000 per year, when you retire in 20 years, it would be the equivalent of $100,000 per year (assuming 3% of inflation).

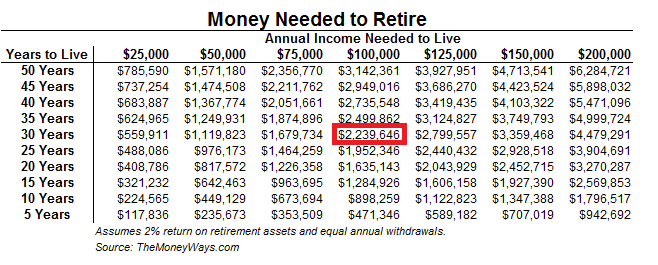

$100,000 annual retirement income means you may need to accumulate $2,239,646 before you retire!

If you save $310 per month, starting at age 20, you could have $1 million at retirement. However, if you start saving at age 50, you will need to save $3,294 per month!

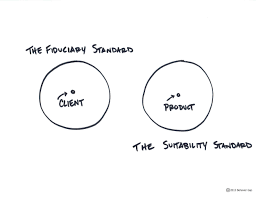

More than 50,000 brokers at large and well-known firms may not be FIDUCIARIES!

See the video about the butchers (brokers) vs. the dietitians (fiduciary).

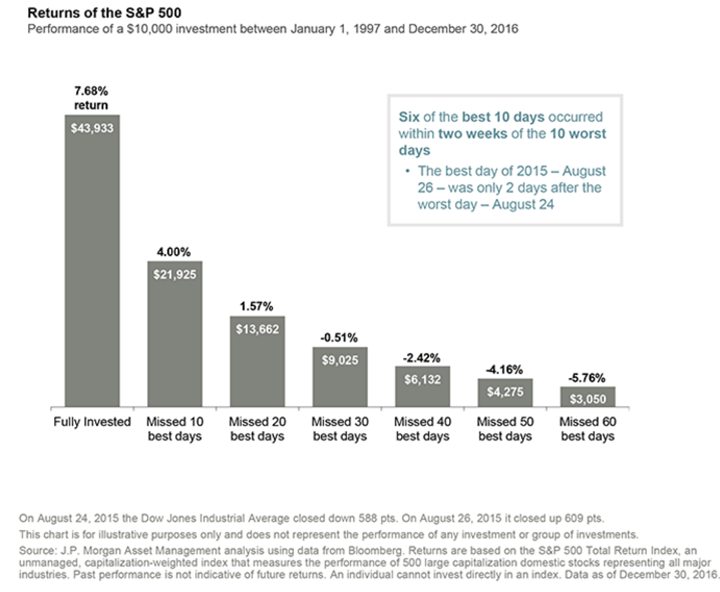

If you were not invested during the top 10 best days of the stock market in the last 20 years, your portfolio would be 50% smaller! You don't need to trade too often.

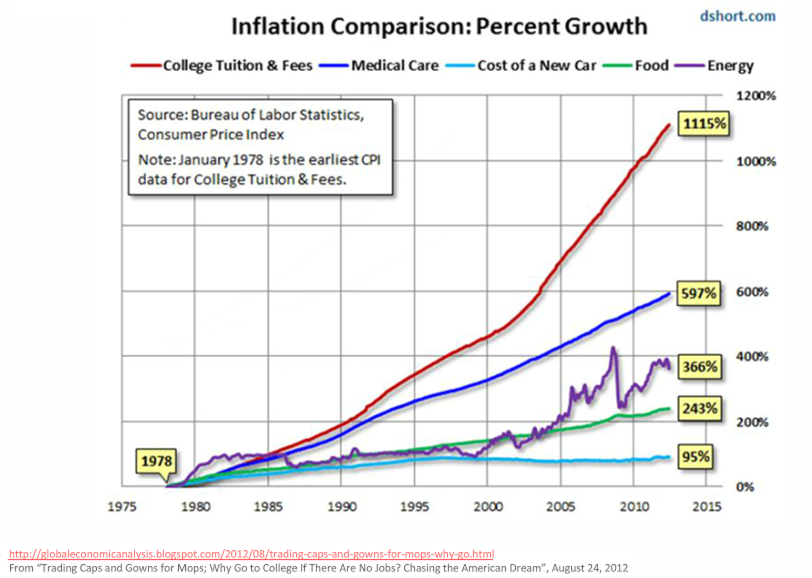

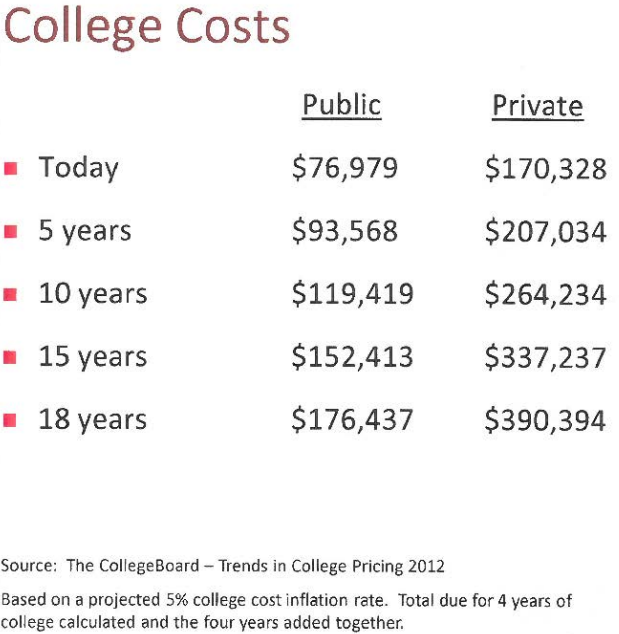

The effect of inflation on your spending! College tuition costs in 18 years will be close to $400,000!

U.S. stocks (S&P 500) went up more than 430% ($10,000 became more than $50,000) since March 2009!

Source: Morningstar

You could save half as much

and still have 47% more at retirement!

If you start to save $10,000 today every year for 10 years only ($100,000 total saved) you will have 47% more in 30 years than if you start to save 10 years later, for the coming 20 years ($200,000 total saved = twice as much). It is $235,000 more!

Note that we assumed 8% annual returns in this hypothetical simulation.

This is called the cost of procrastination.

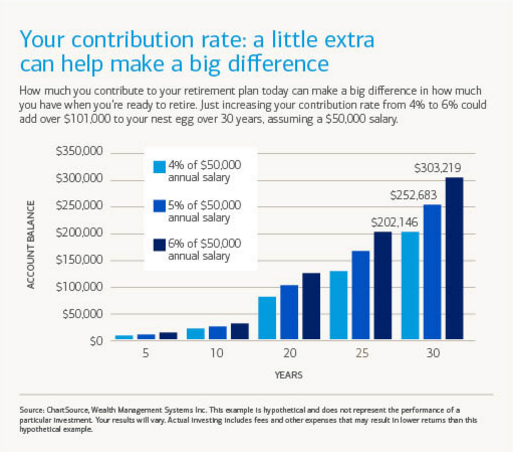

Increasing your annual savings rate by only 2% (from 4% to 6%) may increase your retirement income by close to 50%!

If you increase your portfolio performance by only 1% per year, your retirement assets could last 12 more years!

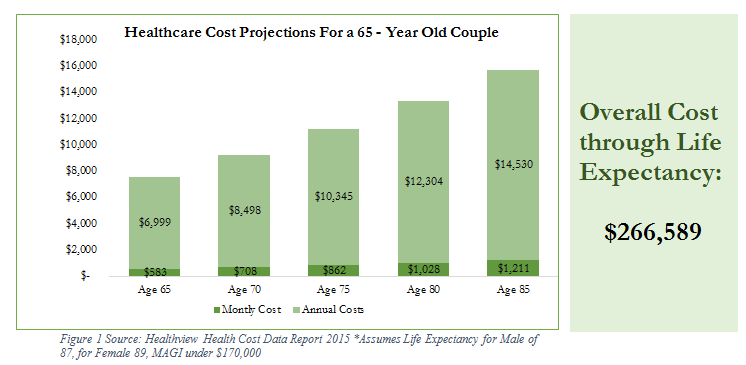

The overall cost of healthcare for a retired couple is over $266,000!

The answer to one of the most important questions (How much equity/stocks should your portfolio have) has so many answers!

For example, at retirement (year 0), some experts believe that you should have 20% of your portfolio invested in stocks/equities but some believe it should be 66%!

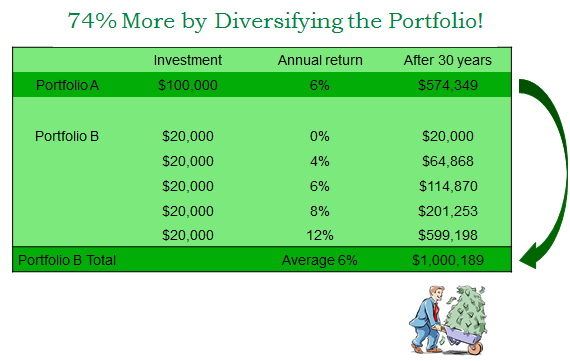

The power of diversification/correlation. Adding a fund C with negative performance (but non correlated) in a portfolio could increase the performance of the portfolio!

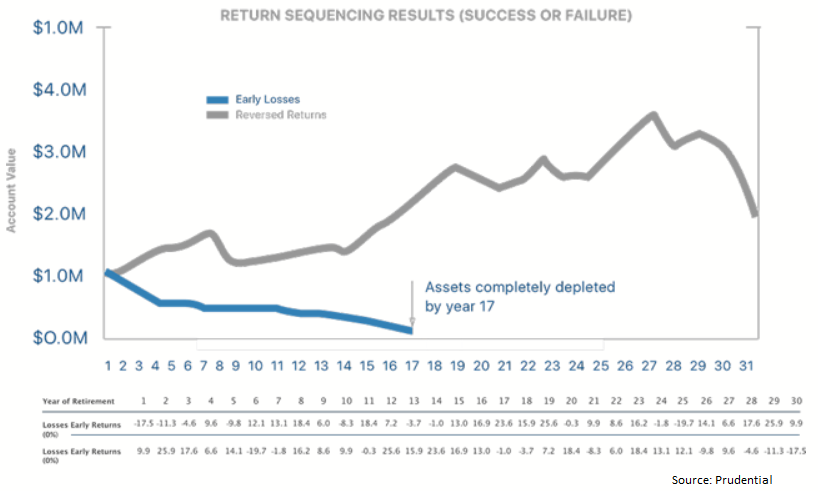

The order/sequence of returns over calendar year makes a LARGE difference in how long you can fund you retirement!

In the example below, both assets have the same returns but in reverse order creating two very different outcomes. The portfolio with 'early losses' is depleted by year 17. Meanwhile, the portfolio with 'reversed returns' lasted for 30 years and increased in value. Each investor starts with $1,000,000 in savings and withdraws $50,000 a year adjusted for 3% inflation.

How much more compensation a typical financial adviser receives now, compared to March 2009 regardless of the portfolio performance!

Since March 2009, an ETF or an index fund following the U.S. stock market went up more than 400%.

An ETF or an index fund following the U.S. bond market went up around 10%.

A balanced portfolio composed of 60% in stocks and 40% in bonds may have had a performance of more than 230% ($100,000 became close to $330,000).

CHECK how much you paid your advisor... Even if a similar 60/40 portfolio poorly performed and merely doubled (+100%) since March 2009, the fees you may be paying most advisers (who are paid fees based in your assets) may have doubled too!

At BFM, we believe that paying an advisor based on your assets creates conflicts of interest (advice on real estate, mortgage, cash reserve,...) so, since inception in 2009, our clients have enjoyed a flat-fee which does not double when the portfolio doubles in size. In addition, we are fee-only since we believe commissions create conflicts of interests.

>> Do you think your physician will double his consultation fees if you eat too much French cheese and your weight doubles?

>> Do you think your accountant will double his fees if you have a great promotion and your compensation doubles?

We invite you to set up a complimentary meeting with the team at Bourbon Financial Management. We would love to get to know you better, your lifestyle, share with you how we help our clients, and also show you how we can be a valuable resource to achieve your financial goals. Understanding and developing long lasting relationships with our clients is a critical component in our process. We look forward to meeting you!

What type of clients do we have? Our clients are located across the globe including North America, Europe and Asia. We have an unbiased approach in selecting our clientele i.e. our client base is broad encompassing expatriates, executives, entrepreneurs, working professionals, and business individuals. We welcome all clients from individuals with wealthy multi-million dollar portfolios to individuals who currently have negative net worth.

We have no portfolio size minimums.

Learn more about our straightforward flat fee conflict-free compensation model.

This newsletter was first published in November in 2019