Let's diversify our portfolio!

Let's Diversify our Portfolio!

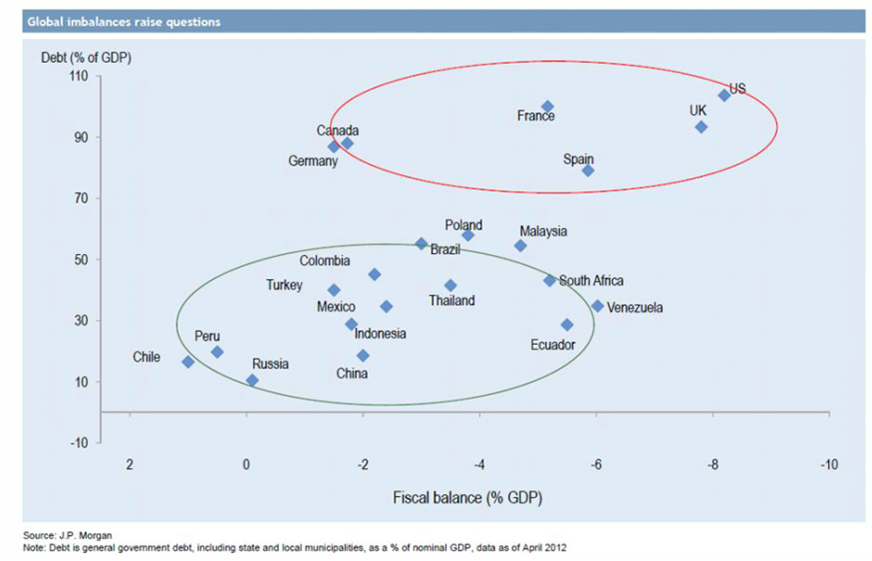

• The purpose of this newsletter is to try to remove some of the home country bias that many of us living in the United States may have. Our goal is to help our clients understand why a portion of their portfolios is invested in international financial markets (20% to 50% of the equities may be allocated in Europe, Asia, and Emerging Markets). Not only do Emerging Markets have much lower debt levels and a younger population, international stocks also seem to be currently cheaper than U.S. stocks.

• You have seen in the last newsletter (Let's Go Global) why diversifying a portfolio with international securities helps increase returns and decrease risks in the long-term. We would like to share some data which may create some long-term concerns for the U.S. if the situation does not improve in the future.

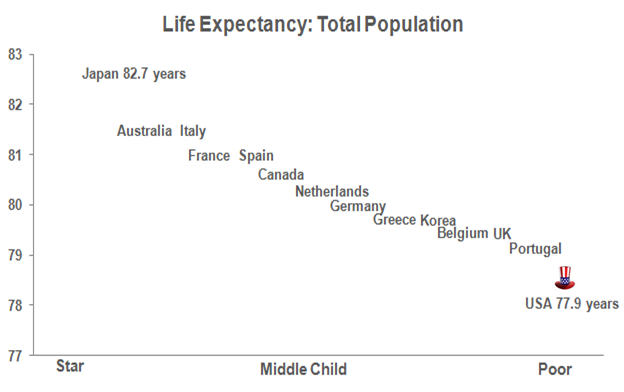

• The U.S. may be on a declining performance trajectory in the areas of Health, Education, and Safety.

• Let’s achieve new greatness for America, but until then, let's diversify our investments globally!

Click Here to Discover the New BFM Newsletter!

Introduction

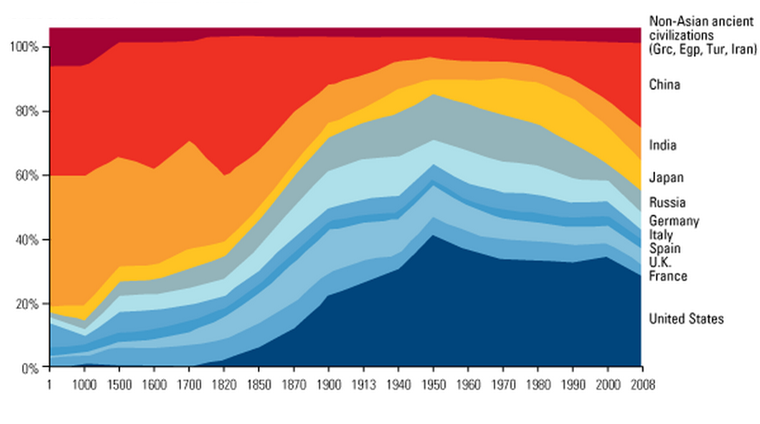

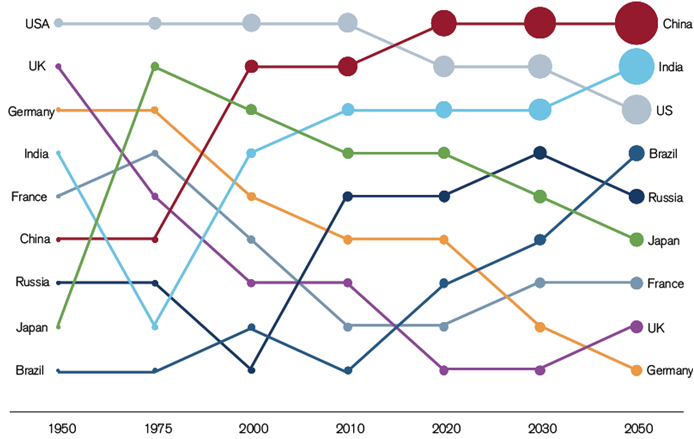

The U.S. economy has improved and the U.S. stock market is up more than 110% since March 2009, and has been up 8 of the last 9 calendar years. While the U.S. will still be the largest economy for a few years, some raise the question - is the U.S. in decline? Is it still number 1?

The U.S. is the leader in many areas, but lags behind in several others. In September, I had the opportunity to meet with Professor Friedman (Columbia University), a leading statistician and health economist for the United Nations, and previously, for the World Bank. His research is one of the sources of the data for this newsletter.

Even if the U.S. is one of the wealthiest countries, the data shows it is poor in many areas (Health, Education, and Safety). There seems to be a large disconnect between perception and data reality.

Patrick Bourbon, CFA

Economic History of Major Powers

GDP 1950-2050

U.S. Has Too Much Public Debt and a Very Negative Fiscal Balance

U.S. Has a Lower Life Expectancy

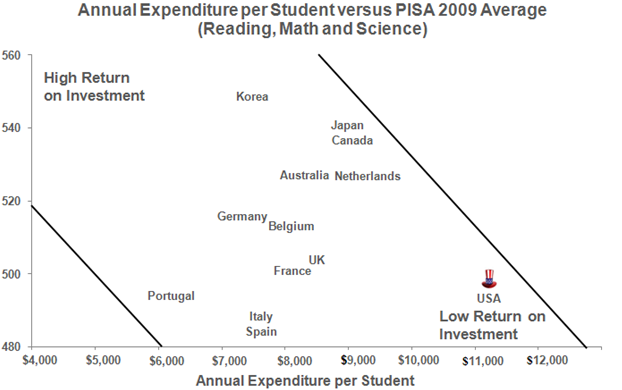

U.S. Has a Lower Return on Investment on Education

This newsletter was first published in October of 2012

http://www.bourbon-fm.com/file/BFM_Newsletter_10_2012_US_Still_Number1