How to research fund managers

How to Research Fund Managers to Reach Financial Security

Executive Summary

At BFM, we believe that if you decide to invest in active mutual funds (as opposed to passive/index funds/ETF), you should have patience and a disciplined due diligence / manager research process.

We are convinced that a blend of active and passive management can increase the chance of reaching your financial goals. Active and passive investments can serve different needs.

Patrick's 9 P Summary

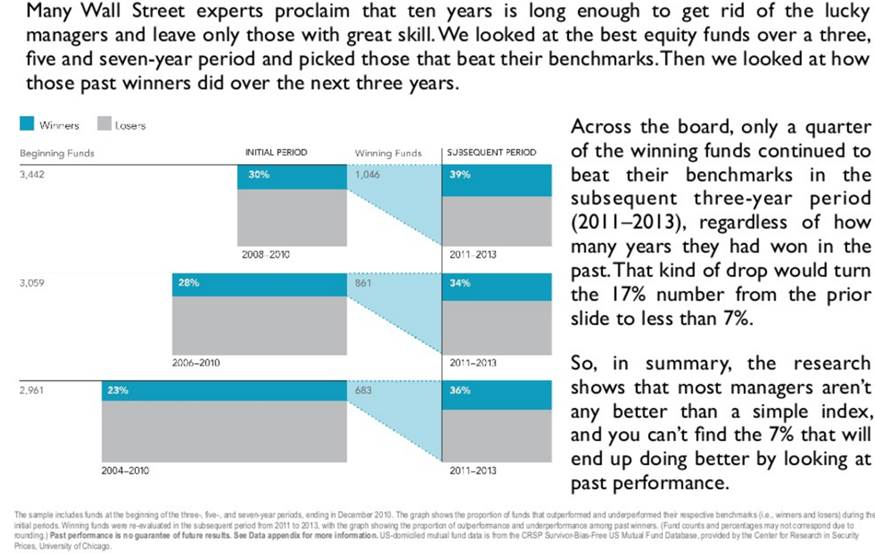

As you can see in the tables below, investors rely heavily on past performance in their fund selection process. The problem is that past performance is of little use in identifying funds who will deliver superior future performance. There is no significant correlation between past relative performance and future relative performance.

You can reduce disappointment with fund manager selection by considering Patrick's “9 P” (people, process, philosophy, price, portfolios, performance, passion, perspective, progress). We believe it is an excellent framework for beginning the analysis of the funds you are interested in. Finally, due diligence isn't a one-time task. Managers have to be checked out regularly.

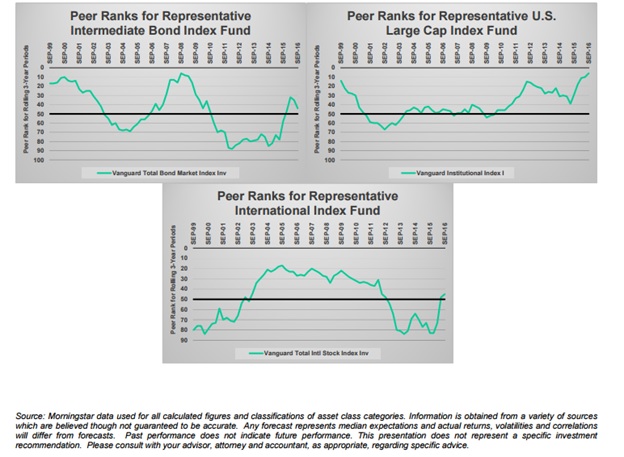

Investing in passive index funds/ETFs does not outperform all the time as you can see below from the research conducted by Dimeo Schneider. The Vanguard index fund could be ranked as poorly as the 90th percentile. There is no consistency in the ranking. By lengthening the period of performance evaluation, the selected active manager has a much higher chance to add value.

Capital Group shows in the study below that a simple selection of funds with lower fees and high manager ownership (see video) can greatly improve the chance of better performance.

Introduction

Many of our clients have asked us how do we select fund managers. The BFM proprietary due diligence process provides a rigorous and disciplined framework for identifying premier investment managers that we recommend to our clients. The process is characterized by a comprehensive and continuous review of many fund managers using a proven methodology and advanced analytical tools.

Some experts believe that 70% to 90% of active mutual fund managers underperform passive or index funds/ETFs after fees and taxes. Some research shows that less than 2% of active equity traditional fund managers have demonstrated evidence of investment skills (most of the time, outperformance is attributed to luck). In the meantime, you can see in the March BFM newsletter (Top 10 Funds), that many active funds have great performance.

Contact Us to Get Your Free BFM Fund Analysis Today!

Why

Research is necessary since the fees/expense ratios of active managers are higher than passive/index funds. Furthermore, most quantitative screens or factors have no alpha/excess returns forecasting predictability.

At BFM, we often recommend investing (for some asset classes) in low-cost passive index funds/ETFs to gain market exposure for a very low fee and less tax liability. But since many of our clients have a long term view we may also recommend active fund managers (especially in the international asset class which may be less efficient) because:

-they may outperform which may help lower savings rates or increase retirement income

-they may provide downside protection when you need it the most when the markets are falling

-they may offer better diversification

-they may be less volatile

A comprehensive study by Altair found that “managers whose 15-year returns from 1998-2013 were in the top quartile in their respective categories outperformed their benchmarks by an average of 4.5 percent per year – providing an average total benefit to clients of $935,000 for every $1 million invested".

Unfortunately, underperformance by fund managers is inevitable, and usually, cyclical (mean reverting alpha). We believe that poor short-term (even three-year) performance could provide investors a great investment opportunity. The focus on short-term performance has cost investors a lot. A Morningstar study shows that for the 10 years ending in December 2013, funds gained an average 7.3 percent annually ($100 became $202) but the typical fund investor earned just 4.8 percent ($100 became $160).

Why have we met with hundreds of managers over the years in Chicago, New York, Boston, San Francisco, Los Angeles, Paris, London, Geneva... ?

1. To avoid a blow up or fraud (Madoff…)

2. To confirm that the manager has the expertise and resources to deliver what he/she promised

3. To learn whether managers possess the key characteristics of successful investors (discipline, intelligence, knowledge, focus, long-term and independent thinking, alignment of interests, passion)

4. To discover the history of the investment and business teams, personnel turnover, compensation structure, firm and investment culture, lessons learned from previous mistakes, and how did they reflect on those mistakes

5. To understand their investment process and determine if it is repeatable, how it has improved, how they generate investment buy, and more important, sell ideas/recommendations, how they think and behave in different market environment, and their knowledge and conviction of the stocks/bonds they invest in

6. To understand what is the true fund ownership by managers. We want managers who eat their own cooking with a compensation structure aligned with clients

7. To find new information about other managers

8. To check if anything has changed in the organization

9. To help us with our investment decisions on adding/dropping/replacing funds. Empirical evidence validates that institutional investors and consultants are too quick to recommend the replacement of poorly performing managers. Overall, the average performance of all managers retained by institutional investors exceeds that of newly hired managers. During 1994-2003, institutional hired managers underperformed fired managers by 1.4% based on post-transaction cumulative 3 year excess returns (see below). Investors tend to chase active performance and buy late in the investment cycle. We try to avoid such mistakes through meetings with managers to dig deep into the reasons behind short-term poor performance.

The BFM Process

We start with manager screening. Our initial screening process relies on objective measures such as fees, turnover, number of holdings, downside capture, manager fund ownership, experience and tenure, firm and product track record and performance, but also incorporates subjective judgment.

Qualitative factors include a deep analysis of the investment team, their investment process, and their firm. We may look at the strength of the team, their experience and tenure, turnover of the investment professionals in the past 5 years, how much fund ownership they have... The goal of this initial search process is to identify a short list of managers with many of the characteristics that we are seeking. These managers are then asked to complete a questionnaire for further evaluation.

The manager selection questionnaire is our tool for gathering detailed information about each candidate in a consistent format. The questionnaire focuses on key aspects: organization, investment philosophy and process, resources, and performance. We follow up by scheduling meetings and calls.

After reviewing the fund presentation, the customized quantitative charts, the questionnaire, the analytical reports, and our detailed meeting notes, we then focus our time on researching the managers with the best qualitative and quantitative factors.

When monitoring the managers selected, we pay attention to following qualitative signals:

• A loss of key investment personnel

• A change in the investment manager’s ownership structure

• Financial condition of the firm

• A major shift in the advisor’s investment philosophy/process

• Client losses and/or declining assets under management

We also monitor quantitative signals. Historical performance results serve to validate (or reject) an investment manager’s investment approach and thereby confirm (or refute) their investment management abilities. Because short-term performance figures are potentially subject to a lot of random ‘noise’, our monitoring program uses long time horizons, typically rolling 5 and 10 years, to evaluate investment performance.

Appendix

Plan sponsors with professional help, like individual investors, often proceeded to fire managers who have underperformed in favor of other recent top performers, only to repeat the cycle again. The study, "The Selection and Termination of Investment Management Firms by Plan Sponsors," reveals the negative impact of manager selection. Goyal and Wahal analyzed hiring and firing decisions made by approximately 3,700 plan sponsors. The chart below shows the results of hiring 8,755 managers over a 10-year period from 1994 through 2003. The chart illustrates that managers that were hired had outperformed their benchmarks by 2.91% over the three years before being hired. However, over the following three years the managers on average underperformed their benchmarks by 0.47% per year.

>> Schedule a meeting with your financial planner who can help you with your portfolios. You want to look ahead!

What type of clients do we have? Our clients are located across the globe including North America, Europe and Asia. We have an unbiased approach in selecting our clientele i.e. our client base is broad encompassing expatriates, executives, entrepreneurs, and working professionals. We welcome all clients from individuals with multi-million dollar portfolios to individuals who currently have a no net worth.

We have no portfolio size minimums.

Learn more about our straightforward flat fee conflict-free compensation model.

This newsletter was first published in April 2017

https://us4.campaign-archive.com/?u=573d134676472fe56336c7f4f&id=c2918431fd&e=e3cd5d6c14